In this article let’s take a look at the features provided by each crypto cold wallet. We will analyze each wallet based on safety, affordability, and compatibility.

TapSigner

( Check Official Website )

The TapSigner crypto cold wallet offers a unique solution for Bitcoin security, blending elements of both hot and cold wallets. Here's a summary of its benefits and drawbacks based on our evaluation:

Benefits 👍

Enhanced Security: TapSigner stores your private keys offline, significantly reducing the risk of online hacking, theft, and other cyberattacks.

Convenience: This hybrid wallet offers a more convenient option compared to traditional hardware wallets, being the size of a credit card and using NFC technology for ease of use.

Physical Security: As a physical card, it can be stored securely in a safe or lockbox, adding an extra layer of security to your digital assets.

Multi-Signature Support: TapSigner supports multi-signature transactions, which require authorization from multiple parties, making unauthorized access more difficult.

Open-Source Software: The software's open-source nature ensures transparency and allows for community-driven security improvements.

Software Wallet Compatibility: While it requires a software wallet for operation, TapSigner is designed to work seamlessly with specific compatible wallets like Nunchuk and Hexa Wallet.

Drawbacks 👎

Software Wallet Compatibility: TapSigner's functionality depends on software wallets for transaction building and broadcasting. Compatibility is crucial for its effectiveness. Currently, Nunchuk is compatible, with plans for Hexa Wallet and BlueWallet. Limited compatibility with specific wallets might restrict users who prefer unsupported wallets.

Backup Process: TapSigner utilizes BIP 32 for XPRV generation and backup, unlike traditional hardware wallets using BIP 39 seed phrases. Encrypted private key file backups are necessary rather than word phrases. The encryption key printed on the TapSigner card requires secure handling for fund recovery in case of loss.

Physical Security: Protecting the physical card and its printed encryption key is crucial for recovery. Cautious offline storage of the backup file is necessary due to symmetric encryption, minimizing brute-force attack risks.

Measures: TapSigner's air-gapped NFC design offers strong online security. However, physical theft or loss can expose vulnerabilities due to its reliance on physical security measures and compatible software wallets.

TapSigner presents an innovative solution for Bitcoin security, allowing users to benefit from the convenience of a hot wallet while enjoying the security of a crypto cold wallet storage. By understanding its benefits and potential drawbacks, you can decide if TapSigner is the right choice for your crypto storage needs.

Satscard crypto cold wallet

( Check Official Website )

The Satscard is a physical NFC-enabled Bitcoin storage card that offers a unique blend of convenience and security for Bitcoin transactions. Here's a summary of its benefits and drawbacks based on the gathered information:

Benefits 👍

Physical and Reusable: Satscard allows for the offline transfer of Bitcoin, providing a tangible and reusable method for transactions.

User-Friendly Experience: The integration of NFC technology streamlines the process of verifying funds and transferring Bitcoin to others, offering a seamless user experience.

Elevated Security: By requiring both the card and a software wallet for transactions, Satscard provides a more secure alternative to standard hot wallets, mitigating risks associated with online storage.

Real-World Convenience: Satscard facilitates physical Bitcoin payments without the need for conversion to fiat currency, making it an ideal solution for real-world transactions.

Anonymity: Satscard supports anonymous transactions, empowering users to pass along Bitcoin without revealing their identity.

Drawbacks 👎

Complex User Experience: The process of using a Satscard might be complex for average users, potentially hindering its widespread adoption.

Loss Risk: There's a risk of losing the card with filled slots, leading to the loss of Bitcoin.

Limited Compatibility: Primarily compatible with the Bitcoin base chain, Satscard may not function with most mobile software wallets, except for the Nunchuck wallet.

Disposal After Use: After ten slots have been used, the Satscard eventually needs to be disposed of, adding an additional step to the user experience.

The Satscard stands out for its innovative approach to combining the physical tangibility of cash with the digital nature of Bitcoin, offering a unique solution for users who value security, anonymity, and the physical aspect of transactions. However, its adoption might be challenged by its complexity for the average person and limited compatibility with software wallets.

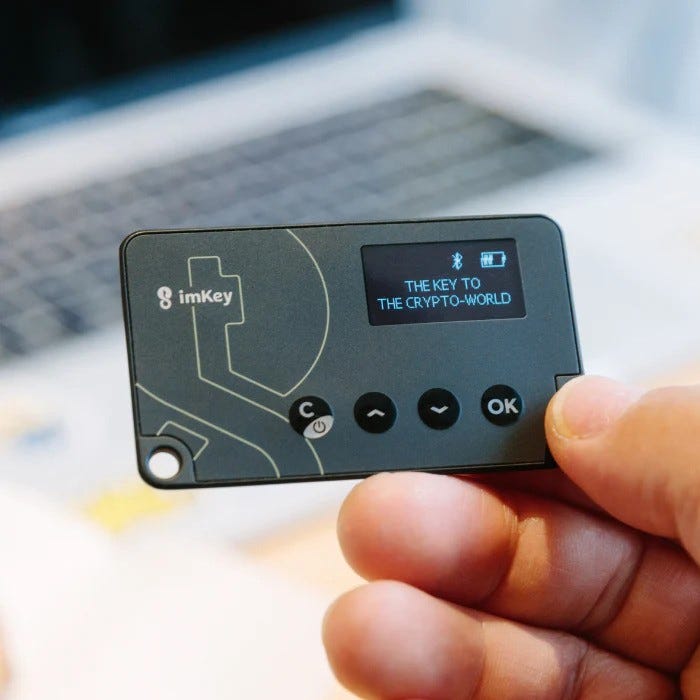

imKey Pro

( Check Official Website )

The imKey Pro is a crypto cold wallet designed to offer a high level of security for your digital assets, with several notable features and benefits, but also with some potential drawbacks to consider.

Benefits 👍

Elevated Security: imKey Pro boasts an Infineon CC EAL 6+ chip, ensuring the highest level of protection for your cryptocurrencies, NFTs, and other digital assets against cyber threats and attacks.

Offline Key Generation: By generating private keys offline, imKey Pro significantly reduces the risk of key compromise by cyber attackers or malware, providing an additional layer of security for your crypto assets.

Diverse Asset Support: ImKey Pro supports a broad spectrum of popular cryptocurrencies like Ethereum, Bitcoin, Litecoin, and upcoming support for Eth2 staking. It's compatible with 11 public chains and allows for customization of RPCs for seamless switching between different chains.

Durability and Ease of Use: ImKey Pro stands out for its durability, boasting a long battery life for extended use. Its security layers are pin-protected and encrypted, providing military-grade safety. Additionally, it includes a mnemonic seed phrase for recovery options.

Convenience and Versatility: The included high-quality leather case makes it easy to carry the wallet along with credit or debit cards. It's an ideal gift for crypto enthusiasts, offering a blend of stylish design and practical utility.

Drawbacks 👎

Complex User Experience: While imKey Pro offers impressive security and functionality, some users may find the initial setup process and overall operation to require a certain level of technical knowledge, which might not be suitable for all users.

Limited Cryptocurrency Support: While it supports a wide range of popular cryptocurrencies and tokens, there might be limitations when it comes to niche or less popular cryptocurrencies.

Leather Case Limitations: While the included leather case is convenient and stylish, it might not accommodate a large number of cards, which could be a limitation for users who carry multiple credit or debit cards.

Overall, the imKey Pro Crypto Hardware Wallet and Seed Phrase Storage Set is designed for individuals who value the security and safety of their cryptocurrency investments. Its high-level security features, support for a wide range of assets, and practical design make it a worthy consideration for crypto enthusiasts.

Disclaimer:

Affiliate Links Disclosure: Please be aware that this website includes product affiliate links. In the event that you make a purchase after clicking on one of these links, we may earn a commission -or- direct payment. This disclosure is made to keep you informed about our affiliate relationships and to maintain transparency. Your support is highly appreciated!

Industry News Update:

Hedge Fund Titans Make Their Bitcoin Play: Wall Street's Most Successful Are Betting on Crypto ETFs

Published Date: Oct 19, 2024

The world's most successful hedge fund managers are quietly placing their bets on Bitcoin, but not in the way you might expect. Through BlackRock's iShares Bitcoin Trust (NASDAQ: IBIT), three legendary investors who've generated the highest net gains in hedge fund history are taking calculated positions in the cryptocurrency market.

Ken Griffin's Citadel Advisors, managing an astounding $494 billion portfolio, has acquired 63,186 shares of IBIT. D.E. Shaw & Company, under David Shaw's leadership, has taken a more substantial position with 2.6 million shares. But it's Israel Englander's Millennium Management that's made the boldest move, securing 10.8 million shares. These positions, while still representing less than 1% of their respective portfolios, signal a significant shift in institutional attitudes toward digital assets.

"We're witnessing a sea change in how Wall Street views cryptocurrency," explains Maria Rodriguez, chief strategist at Morgan Stanley. "These aren't speculative plays – these are calculated positions by some of the market's most sophisticated investors." The timing coincides with Bitcoin's impressive performance, having more than doubled in value over the past year.

The forecasts from Wall Street's leading analysts paint an ambitious picture. Bernstein's Gautam Chhugani projects Bitcoin reaching $500,000 by 2029, while Ark Invest's Cathie Wood envisions a $3.8 million price target by 2030. Perhaps most striking is MicroStrategy's Michael Saylor's projection of $13 million by 2045, with a bull case scenario reaching an astronomical $49 million.

The mathematics behind these projections are rooted in institutional adoption. With approximately $120 trillion in institutional assets under management globally, even a minimal allocation to Bitcoin could trigger substantial price appreciation. "We're looking at potentially $6 trillion in institutional investment by 2030," notes Wood, while Bernstein takes a more conservative stance at $3 trillion by 2033.

Recent data supports this institutional interest trend. The number of institutional investors holding stakes in the iShares Bitcoin Trust has jumped from 450 to 600 between the first and second quarters of 2024. Current ETF holdings of $63 billion represent just the beginning, according to market analysts.

"The shift to ETFs fundamentally changes the game," explains Thomas Chen, cryptocurrency analyst at Goldman Sachs. "It removes traditional barriers to entry and provides a familiar vehicle for institutional investment." The iShares Bitcoin Trust's 0.25% expense ratio significantly undercuts traditional cryptocurrency exchange fees, making it an attractive option for large-scale investors.

However, market veterans urge caution amid the optimism. Bitcoin's history is marked by multiple 50% drawdowns, and theoretical risks extend to complete value loss. "These billionaire investors aren't betting the farm," reminds Sarah Thompson, chief market strategist at Deutsche Bank. "Their positions are sized to reflect both the opportunity and the risk."

The involvement of these legendary investors doesn't guarantee success, but it validates Bitcoin's evolution from a fringe asset to a serious institutional investment consideration. As one senior fund manager noted, "When the world's most successful investors start placing their bets, it's time to pay attention – even if those bets are carefully measured."

For retail investors watching these developments, the message is clear: the smart money is moving into Bitcoin, but with characteristic caution and sophistication. Whether these bold price predictions materialize remains to be seen, but the institutional adoption story is no longer just speculation – it's playing out in real-time through the portfolios of Wall Street's most successful investors.

Note: None of the above is Financial advice. Its only for educational purpose. Crypto is very high risk, and do your complete research and get expert advice before making any decision.