Tangem's Crypto hardware wallet stands out for its innovative use of NFC technology, ease of use, and robust security features. In this Tangem wallet review, lets look at the benefits and drawbacks of this hardware wallet.

( Check Official Website )

Benefits 👍

Simplicity and Accessibility: With its sleek card-shaped design and NFC (Near Field Communication) capabilities, the Tangem wallet offers a user-friendly experience. Manage your transactions with ease by tapping the card to a mobile device equipped with the Tangem app.

Robust Security: Enjoy the peace of mind that comes with EAL6+ security certification, comparable to biometric passports. This high level of security ensures your crypto assets are well-protected against backdoors and undocumented features.

Seedless Solution: Tangem's approach to security stands out - no traditional seed phrase is needed. This feature appeals to users seeking a simpler method of securing their assets without compromising safety. The wallet also supports recovery options within the app, mitigating the risk of loss due to company failure or card loss.

Comprehensive Cryptocurrency Support: Over 2,700 cryptocurrencies, including ERC-20 tokens and NFTs, are supported by the Tangem wallet. Users can manage a wide range of digital assets with this versatile solution.

Affordable Option: Compared to many other hardware wallets, Tangem offers a more budget-friendly option. Packs of two cards start at a lower price point, making it a great choice for those seeking cost-effectiveness without sacrificing quality.

Standout feature:

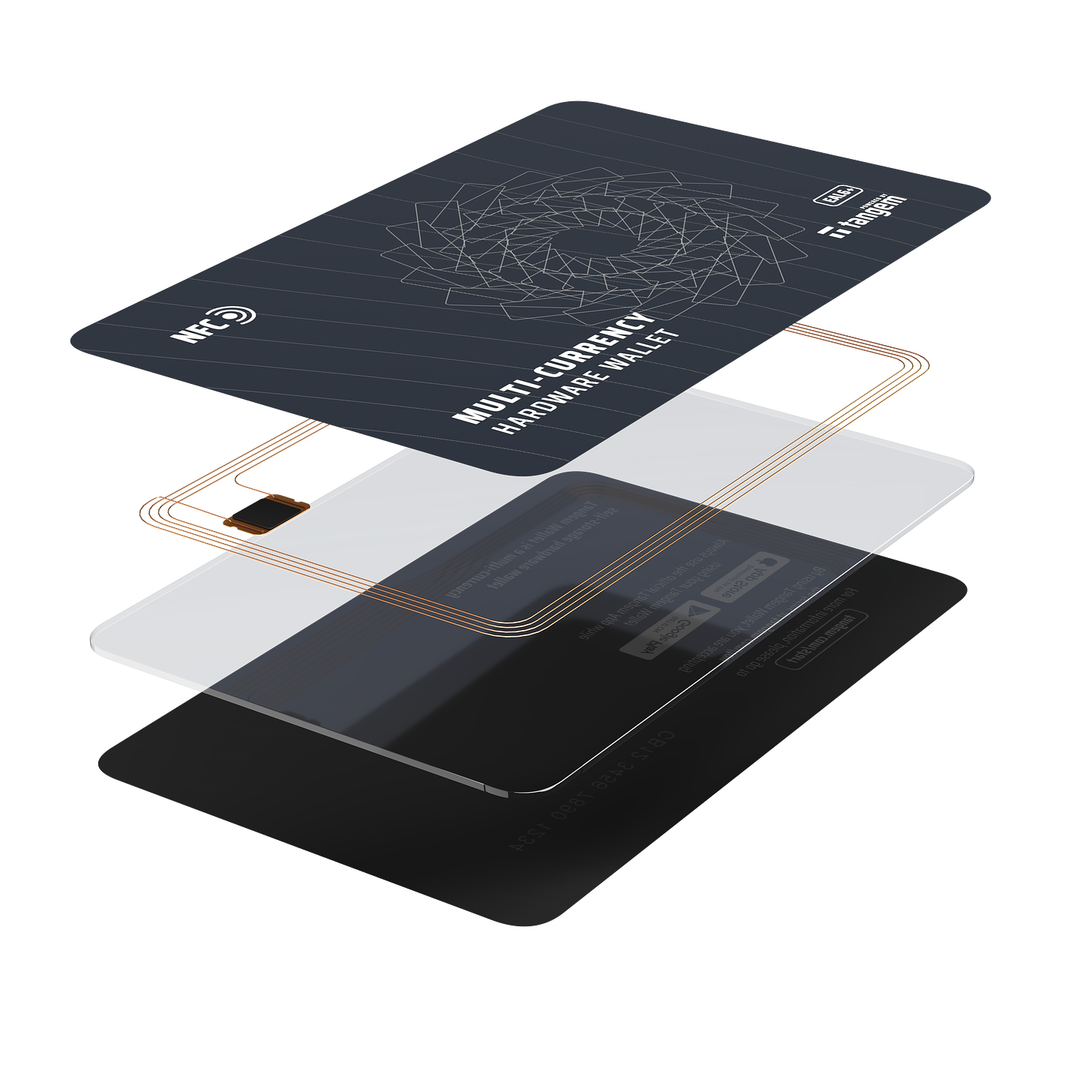

The Tangem crypto wallet sets itself apart in the hardware wallet market through its innovative integration of smartcard technology with NFC (Near Field Communication), offering a user-friendly and secure way to manage cryptocurrencies. This card-shaped wallet simplifies transactions, allowing users to authenticate and sign transactions quickly by tapping it against an NFC-enabled smartphone, without the need for cables or entering seed phrases. With high-security chips (like those in biometric passports) and the ability to bypass traditional seed phrases while ensuring recovery options via the app, Tangem enhances security. It supports a broad spectrum of cryptocurrencies and enables direct in-app buying, selling, and swapping, eliminating the reliance on third-party exchanges and reducing counterparty risk. This combination of convenience, security, and versatility makes Tangem a distinctive choice for both newcomers and seasoned crypto enthusiasts.

Drawbacks 👎

Potential Risks of Losing the Card: As the wallet takes the form of a physical card, there's always the possibility of misplacing it. Tangem addresses this concern by offering packs of two or three cards, and backup features to manage funds if one card is lost 👍

Limited Device Compatibility: Older iPhone models or devices lacking NFC support may not be compatible with the Tangem wallet. Users should ensure their devices meet the necessary requirements to use the wallet seamlessly.

Absence of a Display: Unlike traditional hardware wallets, Tangem's card lacks a display, so users must rely on the mobile app for transaction details. While this hasn't posed any significant issues, some users may prefer direct verification of transactions on their hardware wallet.

In conclusion, Tangem's Crypto hardware wallet offers a compelling blend of user-friendly design, robust security, and comprehensive cryptocurrency support. Its innovative seedless approach to security and affordability make it a standout choice. However, potential users should carefully consider device compatibility and the absence of a display when weighing their options. All things considered, Tangem's offering is a strong contender for those seeking a streamlined and secure way to manage their digital assets.

Industry News

Eye Scans and AI: Altman's 'World' Project Pivots Amid Global Scrutiny

Published date: October 19, 2024

In a bold rebrand that signals growing ambitions beyond cryptocurrency, Sam Altman's controversial Worldcoin project has shed its crypto-centric identity, emerging simply as "World." The move comes as the venture, which has already attracted 7 million sign-ups, unveils next-generation biometric technology amid intensifying regulatory headwinds.

The transformation reflects a strategic pivot that Wall Street is watching closely. "This isn't just a name change – it's a fundamental shift in positioning," explains Sarah Chen, digital identity analyst at Morgan Stanley. "They're moving from cryptocurrency player to global identity infrastructure provider." The stakes are considerable: industry estimates value the digital identity market at $33 billion, with projected growth to $70 billion by 2027.

Behind this ambitious venture stands Tools for Humanity, the parent company that's betting big on a future where AI sophistication will make human verification increasingly critical. Their core offering hinges on the "Orb" – a sleek, sphere-shaped biometric scanner that reads iris patterns to verify human identity. The latest iteration boasts triple the performance capabilities with reduced manufacturing complexity, a development that has caught the attention of institutional investors.

The numbers paint an intriguing picture. With 7 million users already enrolled, World's growth trajectory outpaces traditional financial service adoption rates. However, market analysts note that regulatory challenges have forced operational suspensions in several key markets, impacting potential valuation metrics that industry insiders estimate could reach $10 billion.

"Traditional KYC costs banks roughly $500 per customer," notes Marcus Zhang, fintech analyst at Goldman Sachs. "World's approach could reduce this to under $5 while dramatically improving accuracy." This economic proposition has attracted attention from major financial institutions, though most remain publicly cautious given the regulatory landscape.

The project's unique approach to user acquisition sets it apart from conventional cryptocurrency ventures. Instead of requiring monetary investment, World asks users to contribute biometric data – a strategy that's proven both innovative and controversial. Privacy advocates have raised concerns, while supporters argue it represents a necessary evolution in digital identity verification.

These privacy debates have triggered regulatory responses worldwide. Several governments have suspended World's operations, citing data protection concerns and jurisdictional questions. The company faces a complex balancing act: maintaining growth momentum while navigating an increasingly stringent regulatory environment. Market analysts estimate compliance costs could exceed $100 million in the next fiscal year.

Sam Altman's dual role as OpenAI CEO and World co-founder adds another layer of intrigue. "The convergence of AI and identity verification isn't coincidental," observes Patricia Thompson, chief analyst at Digital Frontier Research. "World is positioning itself at the intersection of two of tech's most critical future challenges: AI disambiguation and human authentication."

The road ahead presents significant challenges. World must convince regulators of its data protection protocols while maintaining the trust of its growing user base. The company's success could reshape how we think about digital identity in an AI-dominated future – or serve as a cautionary tale about the limits of technological ambition in the face of regulatory restraint.

As one venture capitalist noted, "World isn't just betting on a product – they're betting on a future where proving you're human becomes as essential as proving you're you." Whether that bet pays off may depend less on technological innovation and more on regulatory navigation.